Put Calendar Spread - A put calendar spread consists of two put options with the same strike price but different expiration dates. Calendar spreads are also known as ‘time. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. The forecast, therefore, can either be “neutral,” “modestly. A calendar spread is a strategy used in options and futures trading:

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Calendar spreads are also known as ‘time. A put calendar spread consists of two put options with the same strike price but different expiration dates. A calendar spread is a strategy used in options.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A put calendar spread consists of two put options with the same strike price but different expiration dates. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. The forecast, therefore, can either be “neutral,” “modestly. A long calendar put spread is seasoned option strategy where you sell.

Long Calendar Spread with Puts Strategy With Example

A put calendar spread consists of two put options with the same strike price but different expiration dates. Calendar spreads are also known as ‘time. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. A long calendar spread with puts realizes its maximum profit if the stock.

Put Calendar Spread Option Alpha

Calendar spreads are also known as ‘time. A put calendar spread consists of two put options with the same strike price but different expiration dates. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A calendar spread is a strategy used in options.

Bearish Put Calendar Spread Option Strategy Guide

The forecast, therefore, can either be “neutral,” “modestly. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Calendar spreads are also known as ‘time. A put calendar spread consists of two put options with the same strike price but different expiration dates. A.

Put Calendar Spread Printable Word Searches

The forecast, therefore, can either be “neutral,” “modestly. A calendar spread is a strategy used in options and futures trading: Calendar spreads are also known as ‘time. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. A long calendar put spread is seasoned.

Calendar Spread Options Trading Strategy In Python

The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. The forecast, therefore, can either be “neutral,” “modestly. A put calendar spread.

How to Trade Options Calendar Spreads (Visuals and Examples)

A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. Calendar spreads are also known as ‘time. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. A long calendar put spread.

Bearish Put Calendar Spread Option Strategy Guide

The forecast, therefore, can either be “neutral,” “modestly. A put calendar spread consists of two put options with the same strike price but different expiration dates. A calendar spread is a strategy used in options and futures trading: The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time..

Long Put Calendar Spread (Put Horizontal) Options Strategy

Calendar spreads are also known as ‘time. The forecast, therefore, can either be “neutral,” “modestly. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes.

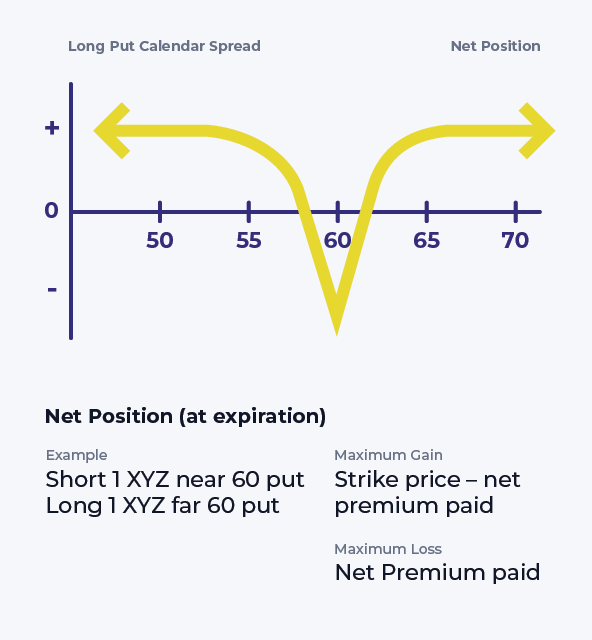

A calendar spread is a strategy used in options and futures trading: The forecast, therefore, can either be “neutral,” “modestly. Calendar spreads are also known as ‘time. The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. A put calendar spread consists of two put options with the same strike price but different expiration dates. A long calendar put spread is seasoned option strategy where you sell and buy same strike price puts with the purchased put expiring one month later. A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put.

A Long Calendar Put Spread Is Seasoned Option Strategy Where You Sell And Buy Same Strike Price Puts With The Purchased Put Expiring One Month Later.

The complex options trading strategy, known as the put calendar spread, is a type of calendar spread that seizes opportunities from time. Calendar spreads are also known as ‘time. A calendar spread is a strategy used in options and futures trading: A put calendar spread consists of two put options with the same strike price but different expiration dates.

The Forecast, Therefore, Can Either Be “Neutral,” “Modestly.

A long calendar spread with puts realizes its maximum profit if the stock price equals the strike price on the expiration date of the short put.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/cdn.prod.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)